Muskingum County Auditor serves as a core administrative authority responsible for property records, valuations, and county financial tracking. This office supports fair taxation by keeping land and ownership data accurate and current. Residents rely on these records for property taxes, exemptions, and transfers. Local governments depend on the same data to plan budgets and public services. Clear recordkeeping helps maintain transparency across Muskingum County, Ohio.

Muskingum County Auditor Office operates as the county’s official source for real estate and fiscal information. The office manages parcel data, assesses property values, and records ownership changes. It works closely with schools, townships, and municipalities to support local funding. Property owners use its tools to review values and tax history. This office plays a steady role in daily county operations and long-term planning.

How to Search Muskingum County Auditor Records

Residents, property owners, and researchers can access Muskingum County public records for property, tax, and assessment information through the Auditor’s office, either online or in-person.

Searching Online Records

The Auditor’s official online search portal allows users to find properties quickly by owner name, address, or parcel number. This portal displays property valuation, tax history, and assessment details.

Steps for online searches:

- Visit the official Muskingum County Auditor Property Search:

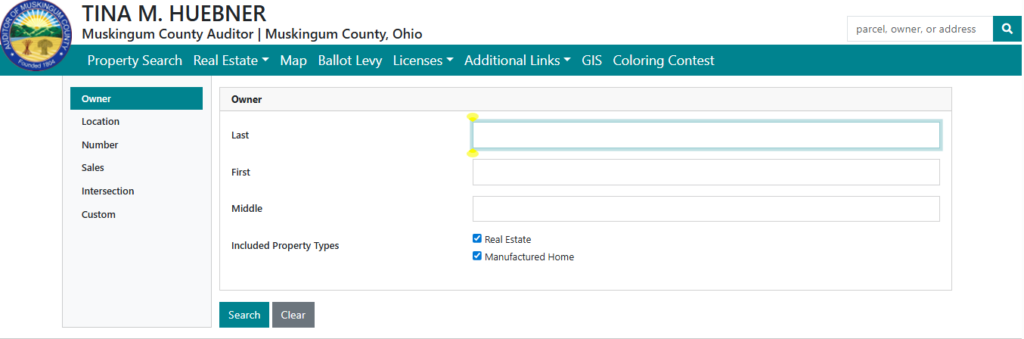

https://www.muskingumcountyauditor.org/Search/Owner - Search by Owner Name:

- Select the Owner tab.

- Enter Last Name, First Name, and optionally Middle Name.

- Ensure Real Estate and Manufactured Home property types are checked.

- Click Search to see results.

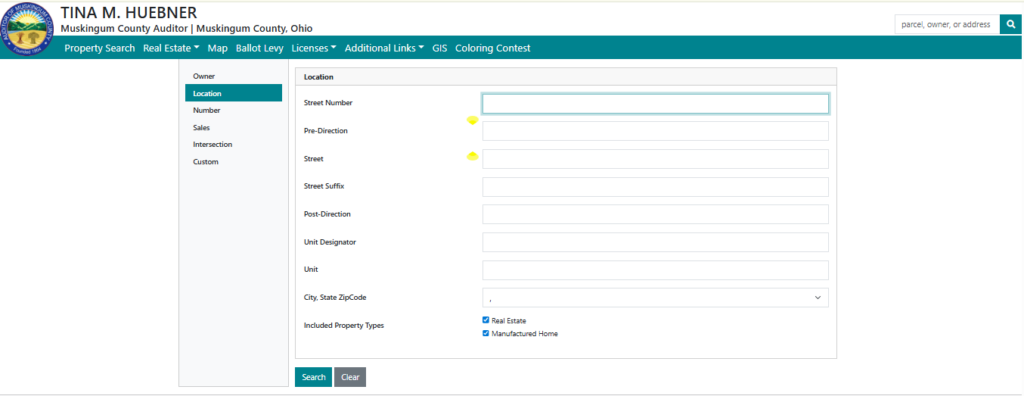

- Search by Location / Address:

- Select the Location tab (as shown in your screenshot).

- Enter the Street Number, Street Name, and City/State/Zip Code.

- Check the property type boxes (Real Estate / Manufactured Home).

- Click Search to display matching properties.

- Browse the results to view:

- Property valuation

- Tax history

- Assessment and parcel details

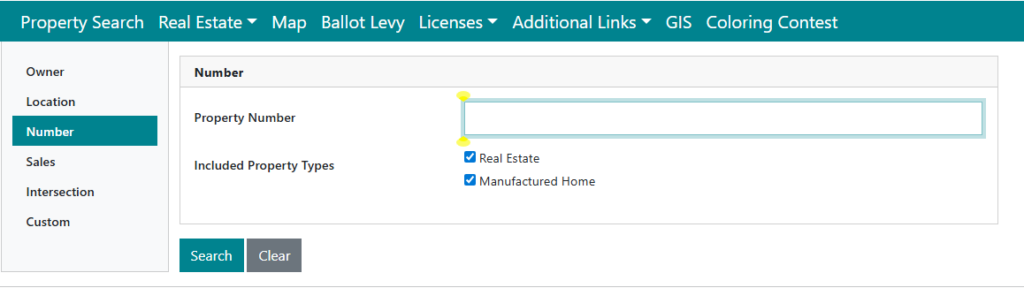

Property Number Search

- Open the official Muskingum County Auditor Property Search page:

https://www.muskingumcountyauditor.org/Search/Owner - In the left menu, click Number.

- Enter the Property Number (Parcel ID) in the search field.

- Enter numbers only, exactly as shown on tax bills or deeds.

- Confirm the Included Property Types:

- Real Estate

- Manufactured Home

(Both are checked by default.)

- Click Search.

- Select the correct record from the results list.

What Users Can View After Searching

Once a parcel is opened, users can review:

- Property valuation details

- Tax assessment history

- Ownership and parcel information

- Land and structure data

- Printable public records

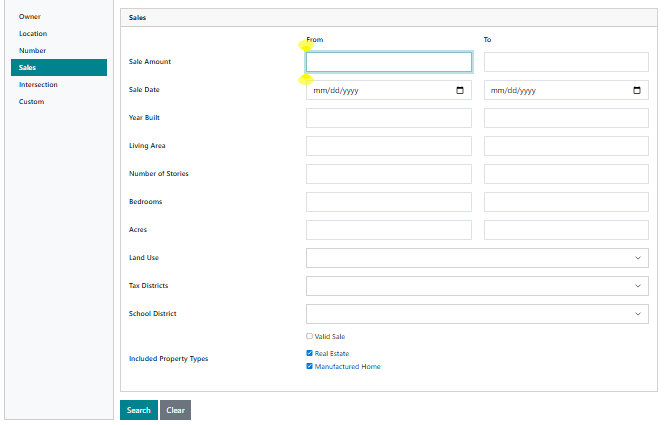

How to Use the Sales Search Tool

The Sales tab lets users filter property transfers using multiple criteria. Users can enter one or more fields to narrow results.

Instructions:

- Visit the official Muskingum County Auditor Property Search portal.

- Select Sales from the left-hand menu.

- Enter search details in one or more fields listed below.

- Click Search to view matching sales records.

Available Sales Search Filters

Users may refine results using these fields:

- Sale Amount (From / To): Set a price range to find properties sold within specific values.

- Sale Date (From / To): Enter a date range to locate recent or past sales.

- Year Built: Filter properties by construction year.

- Living Area: Search by square footage size.

- Number of Stories: Limit results based on building height.

- Bedrooms: Find properties with a certain bedroom count.

- Acres: Filter by land size.

- Land Use: Choose residential, commercial, agricultural, or other classifications.

- Tax Districts: Narrow results by local tax area.

- School District: View sales within a selected school district.

Valid Sale Option

- Valid Sale checkbox:

Selecting this option limits results to verified arm’s-length transactions, which helps with accurate market analysis.

Included Property Types

Users can choose which property types appear in results:

- Real Estate

- Manufactured Home

Both options are selected by default.

What Users Can View in Sales Results

After running a search, users can click any result to view:

- Sale price and sale date

- Parcel number and property address

- Property characteristics and land use

- Tax district and school district details

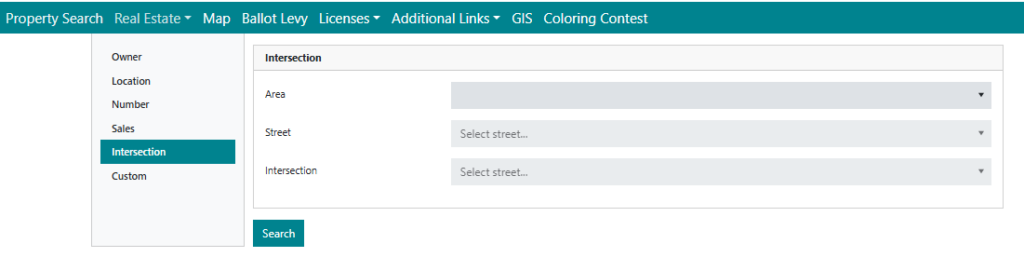

How to Use the Intersection Search

Users can locate property records by selecting nearby streets from dropdown menus.

Steps for Instructions:

- Open the official Muskingum County Auditor Property Search page.

- Select Intersection from the left-hand menu.

- Choose an Area from the dropdown list.

- Select the Street name.

- Select the intersecting Cross Street.

- Click Search to view properties near that intersection.

What This Search Option Shows

After running the search, users can view:

- Properties located around the selected intersection

- Parcel numbers and property addresses

- Ownership and land use details

- Assessment and valuation information

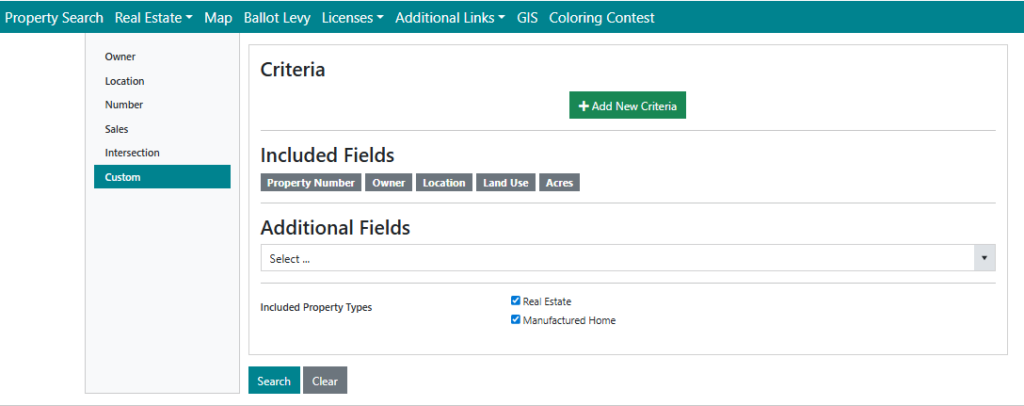

How to Use the Custom Search

- Visit the official Muskingum County Auditor Property Search page.

- Select Custom from the left-hand menu.

- Click + Add New Criteria to begin building a search.

- Choose which fields to include in the results.

- Add optional filters to refine the search.

- Click Search to view matching properties.

Included Fields (Default)

These fields appear automatically in search results:

- Property Number

- Owner

- Location

- Land Use

- Acres

What Does the Muskingum County Auditor Do?

The Muskingum County Auditor manages the county’s finances and ensures public funds are used responsibly. This office also keeps accurate property and tax records to support fair local governance.

Constitutional Role in Ohio Law

The auditor is a constitutional officer under Ohio law, giving the position legal authority and responsibility for county financial management. This role ensures all public records, tax assessments, and financial reports meet state requirements. The office maintains official records for real estate, personal property, and public accounts, which are crucial for proper taxation and transparent government operations.

Key responsibilities include:

- Valuing property for taxation and assessment purposes

- Maintaining ownership and parcel records for accurate tax billing

- Preparing annual financial reports in compliance with Ohio law

- Certifying tax rates and assessments for local governments

Fiscal Oversight and Accountability

Fiscal oversight is at the core of the auditor’s duties. The office monitors all county financial activity, including revenue collection, expenditures, and fund balances. By reviewing transactions and maintaining accurate ledgers, the auditor helps prevent errors or misuse of public funds.

Daily financial oversight tasks include:

- Recording all receipts and expenditures

- Verifying fund balances before authorizing payments

- Maintaining detailed accounting records for each fund

- Preparing statements for public transparency and reporting

Relationship With Treasurer, Commissioners, and Budget Commission

The Muskingum County Auditor works closely with the county treasurer, commissioners, and the Budget Commission to maintain accurate and lawful financial operations. While the treasurer collects and invests funds, the auditor tracks spending and authorizes disbursements.

During budget planning, the auditor collaborates with county commissioners to review revenue estimates and fund allocations. The auditor also serves on the County Budget Commission, which includes the treasurer and the county prosecutor. Together, they approve local tax rates and budgets for municipalities, school districts, and other public entities.

Collaboration highlights:

- Ensures balanced county budgets

- Confirms accurate revenue forecasting

- Standardizes financial reporting across departments

Property Valuation and Real Estate Assessments

Muskingum County’s property valuation process ensures fair and accurate taxation for all property owners. The County Auditor assigns values, maintains property records, and certifies assessments used to calculate local taxes. This work helps homeowners and businesses understand how their property is assessed and supports transparent local governance.

How Property Values Are Determined

Property values in Muskingum County are based on market value assessments. The auditor uses standardized appraisal methods to determine the fair value of homes, commercial properties, and land parcels. These valuations rely on recent sales, property size, location, condition, and improvements.

The real estate appraisal process typically includes:

- Comparing recent sales of similar properties in the area

- Inspecting property features and improvements

- Adjusting values based on unique characteristics or location

Accurate assessments ensure that taxes are fair and consistent for all property owners.

Official Property Search:

Search Your Property in Muskingum County – Look up assessed values, tax history, and parcel details: https://www.muskingumcountyauditor.org/Search/Owner

Reappraisals and Triennial Updates

Muskingum County conducts countywide revaluations on a regular cycle, following Ohio law. These reappraisals and updates make sure property values reflect current market conditions.

Key points in the Ohio property reappraisal cycle:

- Reviewing all parcels for changes in market value

- Updating records with new construction, demolitions, or improvements

- Notifying property owners of changes before tax bills are issued

Property Tax Appeals and Owner Rights

Property owners can challenge assessments they believe are inaccurate through the Board of Revision (BOR). The BOR reviews evidence and can adjust property values when justified.

Steps for appealing a property assessment:

- File a complaint with the Board of Revision

- Provide supporting evidence, such as recent sales data or an independent appraisal

- Attend a hearing to present your case

Muskingum County Tax Assessment and Billing Process

The Muskingum County tax assessment system determines how property taxes are calculated and billed each year. This process follows Ohio law and is managed by the Muskingum County Auditor with support from other county offices. Property values are reviewed regularly to reflect market changes. The goal is to apply taxes fairly across residential, commercial, and agricultural properties. Each assessment directly impacts how much tax a property owner pays. Reviewing assessment details helps owners stay informed about their tax responsibility.

How Assessed Value Is Determined

Property taxes are not based on full market value. Instead, Ohio law sets assessed value at 35% of fair market value. The auditor evaluates sales data, property characteristics, and market trends to determine value. This assessed figure becomes the foundation for all tax calculations. Reappraisals and updates help keep values accurate. Changes in market conditions may raise or lower assessed values over time.

Factors used in assessment include:

- Recent sales of similar properties

- Property size, location, and condition

- Improvements or structural changes

- Local real estate market trends

How Assessed Value Converts Into Taxes

After assessment, taxes are calculated by applying millage rates to the assessed value. A mill equals one dollar of tax for every $1,000 of assessed value. The total tax amount depends on the combined millage for the property’s taxing district. This calculation explains why two properties with the same value may have different tax bills. Location plays a major role in final tax amounts. Reviewing millage rates helps owners understand how their bill is formed.

Millage Rates in Muskingum County

Millage rates represent the tax rates charged by local authorities. These rates vary across Muskingum County based on jurisdiction. County, township, city, and school district rates all contribute to the total. Each authority applies its own millage to fund public services. The combined rate determines the final tax obligation. Millage rates are reviewed annually.

Millage rates commonly fund:

- County and township operations

- City or village services

- School districts

- Libraries and special districts

Role of Levies and School Districts

Levies and school districts account for a significant share of real estate taxes in Muskingum County. Voters approve levies to support education and community services. School district levies often represent the largest portion of a tax bill. Some levies remain fixed, while others adjust with property values. This structure can cause tax changes even if rates stay the same. Understanding levy types helps explain year-to-year bill differences.

Common levy purposes include:

- Public schools and educational programs

- Emergency services

- Road maintenance and infrastructure

- Libraries and community facilities

Ohio Property Tax Calculation

The Ohio property tax calculation process combines assessed value, millage rates, and approved levies. This system ensures local governments receive funding while distributing taxes evenly. Property owners can review tax breakdowns through the Muskingum County Auditor’s public records. Checking assessments and levies helps avoid confusion about billing changes. Staying informed supports better financial planning for property owners.

Muskingum County Auditor and Public Records Access

The Muskingum County Auditor maintains a wide range of Muskingum County public records for transparency and accountability. These records allow residents, property owners, and researchers to review property details, tax data, and official financial information. Ohio law supports public availability of most records kept by the Auditor. Users may review records online or request copies through formal channels. This section explains what records are available and how to locate them.

Available Public Records

The Auditor’s office maintains several categories of public records related to property and taxation. These records document ownership history, assessed values, and tax obligations across the county. Most records are updated regularly and reflect current or recent reporting periods. Public review of these documents supports fair taxation and accurate recordkeeping. Some older records may require special requests for retrieval.

Commonly available records include:

- Property ownership records showing current and past owners

- Tax duplicate records listing billed and paid real estate taxes

- Property valuation and assessment summaries

- Parcel identification and land use details

- Transfer and sales history for real estate

How to Search or Request Records

The Auditor provides Muskingum County auditor online records through an official portal for convenient public review. Users may search by parcel number, owner name, or property location. Online searches display valuation data, tax history, and parcel details. Many records may be printed or saved for reference. This system follows Ohio public records law, which supports public review of non-restricted documents.

Steps for locating records include:

- Use the Auditor’s online portal for parcel or owner searches

- Review displayed property valuation and tax details

- Print or save available records for personal use

- Submit formal requests for copies not listed online

Dog Licenses in Muskingum County

Muskingum County dog licenses are required by Ohio law for all dogs over three months of age. Licensing helps confirm ownership, supports animal safety, and assists local officials with identification when a dog is lost. The Muskingum County Auditor manages licensing records and collects fees on behalf of the county. Dog licenses support local animal control efforts and shelter services. Keeping a license current protects owners from penalties and helps maintain compliance with state regulations.

How to Purchase or Renew Dog Licenses

Dog owners may purchase or complete dog license renewal in Muskingum County through approved methods. Licenses are issued annually and must be renewed before the expiration date to avoid late fees. Owners should provide accurate dog and owner information at the time of purchase. Proof of rabies vaccination may be required depending on the licensing method. Renewal options are designed to be simple for residents.

Common ways to obtain or renew a dog license include:

- Online renewal through the county’s official system

- In-person purchase at the Muskingum County Auditor’s office

- Mail-in renewal using the official license form

- Authorized retail or local agent locations

Dog License Programs and Community Initiatives

Muskingum County participates in county animal licensing programs in Ohio that promote responsible pet ownership. Licensing helps fund animal welfare services, including shelter operations and enforcement activities. These programs improve the chances of reuniting lost dogs with their owners. Community education efforts highlight the legal duty to license dogs and the benefits of compliance. Public participation strengthens county-wide animal safety initiatives.

Dog licensing programs support:

- Identification and return of lost dogs

- Local animal shelter funding

- Enforcement of animal-related regulations

- Public awareness of responsible ownership

Muskingum County Budget Commission and Fiscal Oversight

The Muskingum County Budget Commission is responsible for overseeing how local government funds are allocated and certified each year. This commission ensures that public money is distributed fairly and according to Ohio law. Its decisions directly influence how much funding schools, municipalities, and townships receive. By reviewing financial data and tax revenues, the commission helps maintain fiscal stability countywide. Proper oversight protects taxpayers and supports essential public services.

Auditor’s Role on the Budget Commission

The Muskingum County Auditor serves as a key member of the Budget Commission and plays an active role in financial review and certification. The auditor brings detailed knowledge of property values, tax assessments, and revenue trends. This involvement helps ensure budget decisions are accurate and data-driven. The auditor also supports transparency during county budget hearings. Their participation strengthens accountability across local governments.

Key responsibilities include:

- Reviewing assessed property values and tax collections

- Providing revenue estimates for budget planning

- Participating in official budget hearings

- Helping certify lawful tax rates and funding limits

Budget Certification Process

The budget certification process determines how much funding each local taxing authority may legally receive. School districts, cities, villages, and townships submit their budget requests for review. The Budget Commission evaluates these requests based on available revenues and financial records. Once approved, certified budgets set limits on spending and taxation. This process supports responsible financial planning throughout the county.

Main steps in the process:

- Submission of budget documents by local entities

- Review of revenue sources and financial data

- Certification of tax rates and funding amounts

- Issuance of official budget approvals

Impact on Schools, Municipalities, and Townships

Decisions made by the Budget Commission have a direct impact on Ohio local government funding. Schools rely on certified budgets to plan staffing, programs, and facilities. Municipalities use approved funding to maintain public services such as safety and infrastructure. Townships depend on certified revenues for road maintenance and community operations. Balanced budget certification helps ensure stable services for residents across Muskingum County.

Budget outcomes affect:

- School district operations and long-term planning

- Municipal services and community development

- Township infrastructure and maintenance projects

- Overall fiscal health of Muskingum County

Special Assessments and Refunds

Special assessments in Muskingum County are additional charges placed on certain properties to fund specific public improvements or services. These assessments are separate from regular property taxes and are applied only when a property directly benefits from the project or service. Common examples include watershed management, drainage maintenance, and infrastructure upkeep. Understanding how these assessments work helps property owners avoid confusion when reviewing tax bills. This section also explains how refunds and corrections are handled when errors or overpayments occur.

Watershed and Maintenance Assessments

Muskingum Watershed assessments are fees collected to support flood control, water management, and conservation projects across the region. These charges are often associated with the Muskingum Watershed Conservancy District and may appear as MWCD charges on a property tax statement. The amount assessed depends on property location, classification, and the level of benefit received. These funds help protect property values by reducing flood risk and maintaining essential infrastructure.

Key points to know:

- Assessments apply only to properties within designated watershed areas

- Charges support flood control, drainage, and maintenance projects

- Fees are listed separately from standard property taxes

- Rates may vary based on property type and acreage

How Refunds and Corrections Are Issue

Property owners may be eligible for a property tax refund in Ohio if an overpayment, billing error, or assessment adjustment occurs. Refunds can result from valuation corrections, exemption approvals, or duplicate payments. When an error is identified, the county issues a corrected tax bill or processes a refund according to state guidelines. Refunds are typically issued by check or applied as a credit to future tax bills.

Situations that may qualify for a refund or correction:

- Incorrect property valuation or classification

- Duplicate or excess tax payments

- Approved exemptions applied after billing

- Clerical or calculation errors

Community Outreach and Educational Programs

The Muskingum County Auditor community programs are designed to educate residents while building trust between local government and the public. These initiatives focus on increasing awareness of county services, property responsibilities, and civic participation. Through hands-on activities and educational outreach, the Auditor’s office helps residents better understand how county government works. Community programs also encourage transparency and open communication. By engaging citizens of all ages, the county strengthens long-term public involvement.

Educational Contests and Public Engagement

Educational events and contests play an important role in connecting the Auditor’s office with the community. Programs such as the dog license coloring contest help introduce children and families to local regulations in a fun and accessible way. These activities promote early civic awareness and encourage compliance with county requirements. Public workshops and outreach events also support broader civic education programs. Together, these efforts make county services easier to understand.

Common outreach activities include:

- Youth contests focused on local laws and responsibilities

- School-based civic education programs

- Public information sessions and workshops

- Community event participation by county staff

Why Community Engagement Is Essential in County Leadership

Strong public service outreach improves how residents interact with county government. When people understand services, rules, and processes, they are more likely to participate and comply. Community engagement also allows county offices to gather feedback and address concerns early. This two-way communication helps build public trust. Ultimately, engaged communities lead to more effective, responsive, and transparent local government.

Muskingum County Auditor Office (Ohio)

If you need to reach the Muskingum County Auditor Office in Ohio, here’s all the accurate contact information you need — including office location, phone, email, hours, and key services related to county financial and property records.

Office Location

Muskingum County Auditor’s Office

401 Main Street

Zanesville, OH 43701, USA

Phone and Email

Phone: (740) 455‑7109

Fax: (740) 455‑7182

Email: auditor@muskingumcounty.org

Office Hours

The Muskingum County Auditor Office is typically open:

- Monday – Friday: 8:30 AM – 4:30 PM

- Saturday & Sunday: Closed

Services Offered

The Muskingum County Auditor Office (Ohio) provides a range of services valuable to residents and businesses, including:

- Property records and valuation information — access public property data and assessments.

- Real estate tax assessment support — guidance on taxable property values.

- Public financial reporting and transparency — open records for county fiscal oversight.

- Assistance with exemptions and special assessments — e.g., homestead or veteran property tax relief questions.

Frequently Asked Questions

The Muskingum County Auditor plays a key role in managing the county’s finances, property records, and public accountability. Residents often have questions about property taxes, dog licenses, financial reports, and other services provided by the office. This FAQ section is designed to provide clear, detailed answers to the most common inquiries, helping Muskingum County residents navigate county services quickly and efficiently.

Who is the Muskingum County Auditor?

The Muskingum County Auditor is an elected official who oversees the county’s financial operations and ensures transparency in government spending. Responsibilities include maintaining property ownership records, assessing property values for taxation, and managing county revenue data. The auditor works closely with other county offices, including the Treasurer and Commissioners, to maintain fiscal accountability and support public services.

How do I check my property taxes in Muskingum County?

Property owners in Muskingum County can check their tax information online through the Auditor’s website or by contacting the office directly. The online portal allows residents to view property assessments, current tax balances, payment history, and tax due dates. For assistance with disputes, exemptions, or corrections to property records, residents can schedule an appointment or submit an inquiry via email or phone.

Where do I buy a dog license in Muskingum County?

Dog licenses in Muskingum County are issued by the Auditor’s Office. Residents can purchase licenses in person at 401 Main Street, Zanesville, OH 43701, during regular business hours. The office provides guidance on the requirements for dog ownership, fees for licenses, and penalties for late or missing registrations. Some counties also offer online options for renewal, so it’s recommended to check the Auditor’s website for digital services.

When is the Muskingum County Auditor Office Open?

The office is open Monday through Friday, 8:30 AM – 4:30 PM, excluding county-observed holidays. During these hours, residents can visit the office for property record requests, tax payments, or other auditor-related services. It’s advisable to call ahead for specific services or to schedule appointments, especially for detailed property research or financial inquiries.

How Do I Request Property Records from the Auditor?

Property records, including deeds, assessment values, tax maps, and historical documents, are available through the Auditor’s Office. Requests can be made in person, by phone, or via email. Some documents may be accessible online for quick reference. These records are essential for property transactions, legal matters, and verifying ownership or tax status.

Can the Auditor Share County Financial Reports?

Yes, the Muskingum County Auditor publishes annual financial statements, budget reports, and other fiscal documents to ensure transparency. Residents, businesses, and government entities can review these reports to understand how county funds are allocated and spent. The auditor’s oversight helps maintain accountability in areas such as public services, infrastructure projects, and community programs.